If you have a homeowners insurance policy, you expect it to be there when something goes wrong. But what if there’s a relatively small problem, like a cracked or broken window? Does homeowners insurance kick in then? It depends on why the window broke. Here, we’ll give you a rundown of when you can count on insurance to replace a broken window.

What caused the window damage?

Imagine that someone buys a great old home, but the windows are drafty and need to be replaced. Homeowners insurance won’t pay to replace windows that no longer function properly due to wear and tear.

Now, let’s say a window is broken by a covered peril, like vandalism, someone breaking into the house, a storm, or a fallen tree branch. As long as the broken window was a result of a covered peril, homeowners can expect their insurer to pay.

The only exception may be if a window was damaged prior to the event. If a person lives in a home with dry rotted or drafty windows, their best bet is to speak with an insurance agent before peril hits to ensure coverage will be there if they need it — regardless of the age of the home. One hallmark of top home insurance companies is their willingness to respond to customer questions.

Situations when homeowners insurance covers broken windows

If any of the standard perils listed in the homeowner’s policy occur, their insurance company will pay to replace damaged windows. Here are some examples of typically covered perils:

- Vandalism

- Break-ins

- Theft

- Fire

- Hail

- Fallen trees

If you find that your current insurer is stingy with coverage, it’s okay to shop around. There are plenty of reasons to change homeowners insurance companies.

Situations when homeowners insurance does not cover broken windows

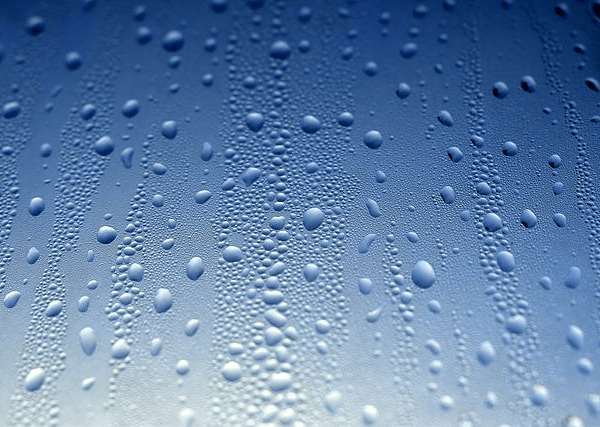

One of the common mistakes people make when buying homeowners insurance is believing it will cover anything that goes wrong in and around the home. As mentioned, a home insurance policy does not cover maintenance issues, like dry rot or drafty windows. For example, if condensation builds up between double-pane windows due to a broken seal, insurance will not cover the cost of repairing or replacing the window.

The simplest way for a homeowner to know if an insurance company will cover window replacement is to check their insurance policy for a list of covered perils. Let’s say a wind storm blows through and flying debris breaks a large window. Wind storms are considered a covered peril, and anything damaged due to that peril is covered.

What if someone breaks your window?

Let’s say that kids from the neighborhood are out playing catch, and a ball goes through your kitchen window. It’s the neighbor’s homeowners or renters insurance that should cover the loss. If they don’t carry liability coverage and you have proof of who broke the window, you have the option of taking them to small claims court.

What if you …….

Source: https://www.fool.com/the-ascent/insurance/homeowners/does-homeowners-insurance-cover-broken-windows/